We expect OOH ad spend to accelerate, following new estimates of tax-enhanced GDP growth.

Anticipated Effects of the New Tax Bill on the OOH Industry:

Non-REIT out of home media companies will experience:

– Reduction in corporate tax rate from 35% to 21%;

– Ability to deduct full amount of capex for tax purposes for the next five years.

Advantages of REITs vs. C-Corps will be reduced given lower tax rate for C-Corps.

REIT dividends for shareholders continue to be treated as pass-through income at new lower rates:

– Given REIT benefits, it makes sense for OUTFRONT and Lamar to continue as REITs, but companies currently evaluating a possible REIT conversion may be less incentivized to do so, considering the reduced corporate tax rate.

While prior versions of tax bill explored the possibility of eliminating tax deduction for advertising, the current bill maintains it. This is a significant win both for the OOH industry and for the economy as a whole.

• Advertising is a key job creator – IHS found in 2015 that 14% of US jobs are related to advertising;

• Dis-incentivizing advertising would reduce the flow of information about products and services to consumers, likely causing consumer backlash and associated pressure on politicians.

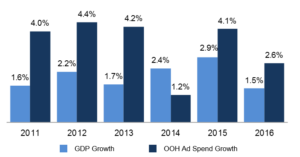

Historical OOH Spend and GDP Growth:

In the past several years, out of home ad spend has generally grown at twice the rate of GDP growth.

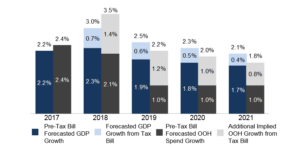

Projected Boosted OOH Spend and GDP Growth:

The new bill is expected to boost real GDP growth during the 2018 – 2021 period.

Source: IMF, TPC, eMarketer, PJ SOLOMON estimates. (a) PJ SOLOMON OOH sector forecast assuming similar OOH / GDP correlated growth.

Disclaimer:

This presentation has been prepared solely for informational and illustrative purposes and is not to be used or considered as an offer to sell, or a solicitation of an offer to buy, any security or the provisions of an offer to provide investment services.

PJ SOLOMON makes no representation as to the accuracy or completeness of the information contained herein, all of which is subject to change without notice. No action, omission, recommendation or comment made by PJ SOLOMON, or its directors, officers, employees, or agents in relation to the transactions described herein shall constitute, or be deemed to constitute, a representation, warranty or undertaking of or by PJ SOLOMON.

This document is general in nature and does not purport to be a complete description of any particular product or service. This document is not intended to be relied upon as the basis for an investment decision.

The contents of this document are not to be construed as legal, accounting or business advice. Each recipient should consult its own attorney, accountant and business advisor as to legal, accounting and business advice. PJ SOLOMON is not recommending that any recipient of this document enter into any investment or transaction described herein and does not represent or warrant that any investment or transaction described herein is a suitable investment for such recipient.

Any discussions of past performance should not be taken as an indication of future results, and no representation, expressed or implied, is made regarding future events or results. Any discussion of future events or results is speculative and may not occur.

Information in this presentation relating to parties other than PJ SOLOMON, or taken from external sources has not been subject to independent verification, and PJ SOLOMON makes no warranty as to the accuracy, fairness or completeness of the information or opinions in this presentation. Neither PJ SOLOMON, nor its representatives shall be liable for any errors or omissions or for any harm resulting from the use of this presentation, its contents or any document or information referred to in this presentation.

The products and services discussed in this presentation are offered by various PJ SOLOMON Corporate & Investment Banking Americas legal entities, including but not limited to PJ SOLOMON or PJ Solomon Securities, LLC or through its foreign affiliates.