The following excerpts are quoted from Solomon Partners’ Media Monthly Report, January 2023.

SOLOMON’S PERSPECTIVE: TRENDS SHAPING THE DIGITAL SIGNAGE INDUSTRY

In the past decade, digital signage has sprung to the forefront of the advertising industry for its ability to dynamize content creation and exhibition, improve customer experience, and boost sales and retention with customers.

Digital signage is any sort of electronic display technology that can be used to transmit videos, images, webpages, and other content.

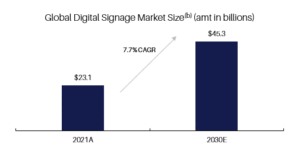

A recent study cited that 60% of enterprises that do not currently possess digital signage plan to implement the technology within the next two years(a), and another study expects global digital signage industry revenue to reach $45.33 billion by 2030 (7.7% CAGR)(b).

Amid this growth, there are numerous underlying trends and applications of digital signage that will continue to define the sector as it rapidly develops. The initial trend is the constant endeavor for businesses to connect better with their customers.

With retailers aiming to improve the in-store experience for consumers relative to competitors, many have taken to digital signage as a medium to make orders or purchases, interact with and learn about products, and drive traffic toward specific items in stores.

According to recent research, 76% of consumers say they have made a purchase based on information they saw on digital signage(c), further proving the efficacy of digital signage in a retail context.

Another similar trend driving businesses toward digital signage is the fight for customers’ attention and memory.

In a world filled with a plethora of brands and sources of media, and where the average consumer is exposed to thousands of messages each day, the importance of choosing efficient and effective advertising channels is greater than ever.

Digital out-of-home advertising provides brands the ability to target customers with pertinent messaging that can be deployed programmatically.

According to a study, unaided recall rates in digital out-of-home ads are 7 to 25% higher than other forms of media such as TV and social media(d), further demonstrating the power of digital signage to generate fruitful, lasting messages.

Additionally, developments in technology more broadly have further highlighted the capabilities that digital signage will hold in society for years to come.

Advances such as artificial intelligence and machine learning, application programming interfaces (APIs), or even the revival of QR codes have melded harmoniously with the advancement of digital signage and helped make it more insightful, interactive, and useful for both media owners and consumers.

(a) Mvix Digital Signage.

(b) Grand View Research.

(c) Popshap.

(d) The Drum.

SOLOMON’S BENCHMARKED 2023 ADVERTISING SPEND FORECASTS

Major advertising agencies such as GroupM, Magna, and Zenith expect 2022 year-over-year US ad market growth of 9 to 12% (~20% in 2021)(a), suggesting that a much-discussed potential recession is not currently impacting the advertising market.

Despite inflation, a bear marketplace, and geopolitical tension, reaching consumers and building brand awareness continue to be high priorities for most businesses. Adjusting for the impact of cyclical events, such as the 2022 FIFA World Cup and the US midterm elections, ad spending in 2022 is projected to grow at a number closer to 8%(a): a strong figure.

In 2023, where some recessionary fears have shifted, the advertising market is still expected to grow from 3% to 6%(b), based on studies from Dentsu, GroupM, Magna, and Zenith.

A recent study by Magna cited economic uncertainty and third-party cookie blocking as reasons it was reducing its growth forecast for the 2023 ad market. However, Magna still forecasts growth to be ~5%(c), suggesting ad market strength despite those cited factors.

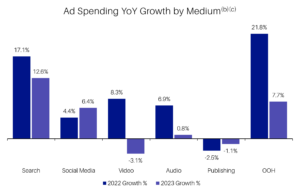

As 2022 transitions to 2023, we expect advertisers to continue to shift ad spend between different mediums, as advertisers spend their budgets as efficiently as possible.

We continue to expect existing media trends to accelerate– e.g., local television is slated to continue to see decreases of more than 20%(c). Meanwhile, search, short-form video, and CTV/ad-based video on-demand should see large increases(c).

Out-of-home and cinema advertising, which have been recovering steadily since the pandemic, are also expected to grow into 2023. In 2022, out-of-home spending grew by more than 21%(c) as society began to return to its natural state of mobility and physical traffic.

Magna expects out-of-home advertising spend growth to continue into 2023, forecasting ~8%(c) growth for the year in its revised forecast.

Select sectors driving ad spend are also expected to continue post-pandemic recovery, including entertainment, travel, betting, and automotive. Meanwhile, Magna states that brands selling food, drinks, personal care and household goods are “especially at risk as [brands] are forced to increase product prices and face the possibility of consumers trading down in favor of cheaper brands.”

(a) Consolidated 2021/2022 US ad forecast reports from Magna, GroupM and Zenith.

(b) Consolidated 2023 US ad forecast reports from Dentsu, GroupM and Zenith.

(c) 2023 Magna US ad spend forecast report.

Companies that can optimally balance a marketing budget amid multifaceted tensions while simultaneously maintaining strong brand presence in a competitive market will come out of a recession strongest.

Though overall growth rates are forecasted to be lower than 2022, research firms continue to predict overall ad spending growth in 2023.

US ad revenue is expected to cross $300 billion this year for the first time as well as reach over $900 billion globally(a).

External pressures are expected to change the advertising landscape, requiring companies to use the most efficient marketing and advertising channels, including out of home media, in order to reach prospective customers and build and maintain their brands.

- US Advertising Sales Projected to Pass $300 Billion (adweek.com).

- Consolidated 2023 US ad forecast reports from Dentsu, GroupM and Zenith.

- (c) 2023 Magna US ad spend forecast report

Click the image below for full report: