PQ Media report says global digital out-of-home ad spend grew 24.9% in 2022, and 36.9% in the US

Tuesday, January 10, 2023

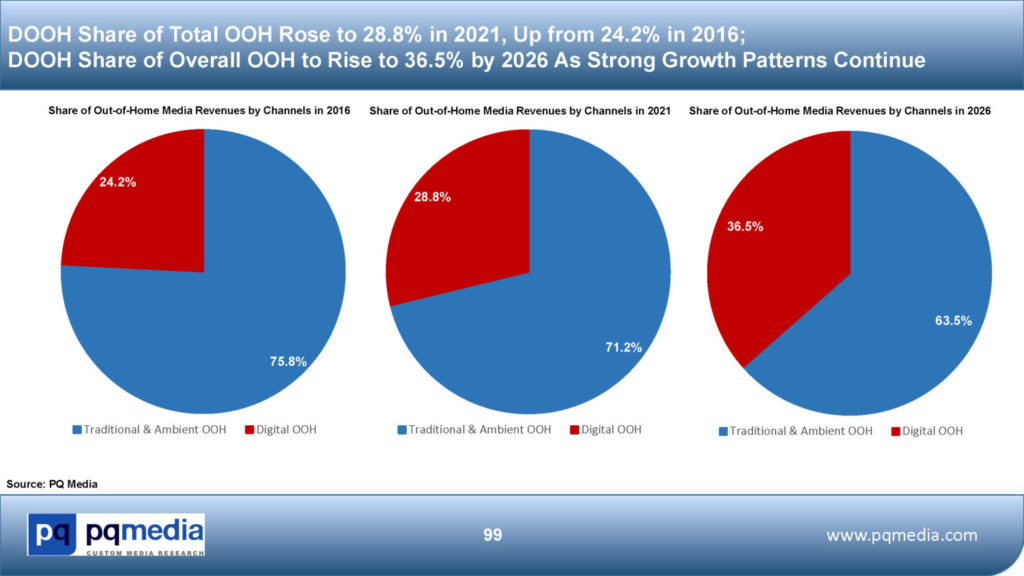

Global digital out-of-home (DOOH) media spending, including digital place-based networks and digital billboards & signage, grew 24.9% in 2022, driven by a 36.9% surge in the United States, as both global and US DOOH ad spend are poised for strong growth again in 2023, according to new research from PQ Media.

Emerging strong from the debilitating impact of the pandemic and the global lockdowns, DOOH media became one of the fastest-growing media sectors in the world in 2022. After plunging 26.0% in 2020, global and US DOOH ad spend rebounded for two consecutive years of double-digit growth, fueled by various red-hot DOOH network and signage segments, according to PQ Media’s Global Digital Out-of-Home Media Forecast 2022-2026.

Global digital place-based network ad spend jumped 25.7% to $12.29 billion in 2022, global digital billboards & signage surged 23.5% to $6.56 billion, driven by high double-digit growth in the healthcare, retail, sports & entertainment, transit, and the heavily battered cinema category, according to PQ Media.

“We expect the DOOH media industry to continue its double-digit growth in 2023, powered by a number of positive developments fueling innovation, creativity and further expansion. Among these are increased and improved programmatic advertising, smart technology marketing, better ROI measurements, and successful efforts by DOOH industry executives and trade organizations at pitching the convincing story that DOOH media has evolved to an extent that clearly indicates its positive impact on brand equity, company reputation and emotional connections with target consumers throughout the day,” said PQ Media CEO & Founder Patrick Quinn.

While recessions have negatively impacted OOH media throughout the medium’s history, the pandemic was especially brutal due to the devastating combination of the ad pullback amid weakening economic conditions and the stay-at-home mandates that sapped consumer traffic from key OOH media locations worldwide.

Aside from grocery stores, pharmacies and big-box retailers, the majority of digital place-based networks and digital billboards & signage operating at roadside, cinema, sports & entertainment and transit locations saw plummeting ad revenues because of stay-at-home restrictions and store closures during the lockdown.

However, PQ Media’s new research shows that nearly all key indicators and drivers of overall OOH and DOOH media growth are showing strong growth signals. Among these are the following:

-

- Consumers are shopping at brick-and-mortar stores again, as monthly foot traffic has risen by double-digit rates in the US for more than a year;

-

- People are driving and taking mass transit again, with US miles driven up 11.2% in 2021 and rising nearly 2.5% in 2022, besting pre-pandemic levels, although train ridership was still well below pre-pandemic peak levels in 2019;

-

- Consumers started flying and staying at hotels at increased rates during the past 18 months, as global airline passengers rose 71% in 2022 and worldwide global tourism soared 172%, although total numbers are still below 2019;

-

- Movie theaters reopened, albeit, with social distancing in some markets; US and Canada admissions were up 69.8% in 2021 and 122% in 2022, while global revenues grew 76% in 2021;

- Consumers also began to attend live sports & entertainment events again, as the 2021 Summer Olympics posted the highest ad revenues ever and the 2022 World Cup began offering real-time stats and results via DOOH networks and signage

Global and US DOOH media revenues are projected to rise at double-digit rates again in 2023, although at slower rates than the record-setting 2022 growth surge, which was led by digital cinema networks (up 59.4%), digital transit nets (up 45.1%), digital retail nets (up 38.5%), and digital healthcare nets (up 24.1%), according to the new PQ Media report.

About the Forecast

This special edition of the Global DOOH Media Forecast was published in conjunction with the return of several major in-person DOOH trade shows and events in 2022, including the newly launched Digital Signage Experience (DSE) in Las Vegas in November 2022 after a three -year hiatus.

Site licenses to the new Forecast include both an in-depth PDF report with 200 slides of original data and analysis; and a deep-dive Excel databook featuring thousands of drill-down datasets and actionable datapoints for the most comprehensive coverage of the OOH media industry available.

To download a FREE Executive Summary, Table of Contents and Sample Datasets from the new Forecast, click: https://www.pqmedia.com/product/global-digital-out-of-home-media-forecast-2022-2026/.

About PQ Media

PQ Media delivers intelligent data and analysis to executives at the world’s leading media, entertainment and technology organizations through syndicated market intelligence reports, custom drill-down market research and strategic advisory services. PQ Media uses a proprietary econometric methodology to define, segment, size and project the growth of more than 300 traditional, digital and alternative media by country, sector, platform, channel and consumer demographic.